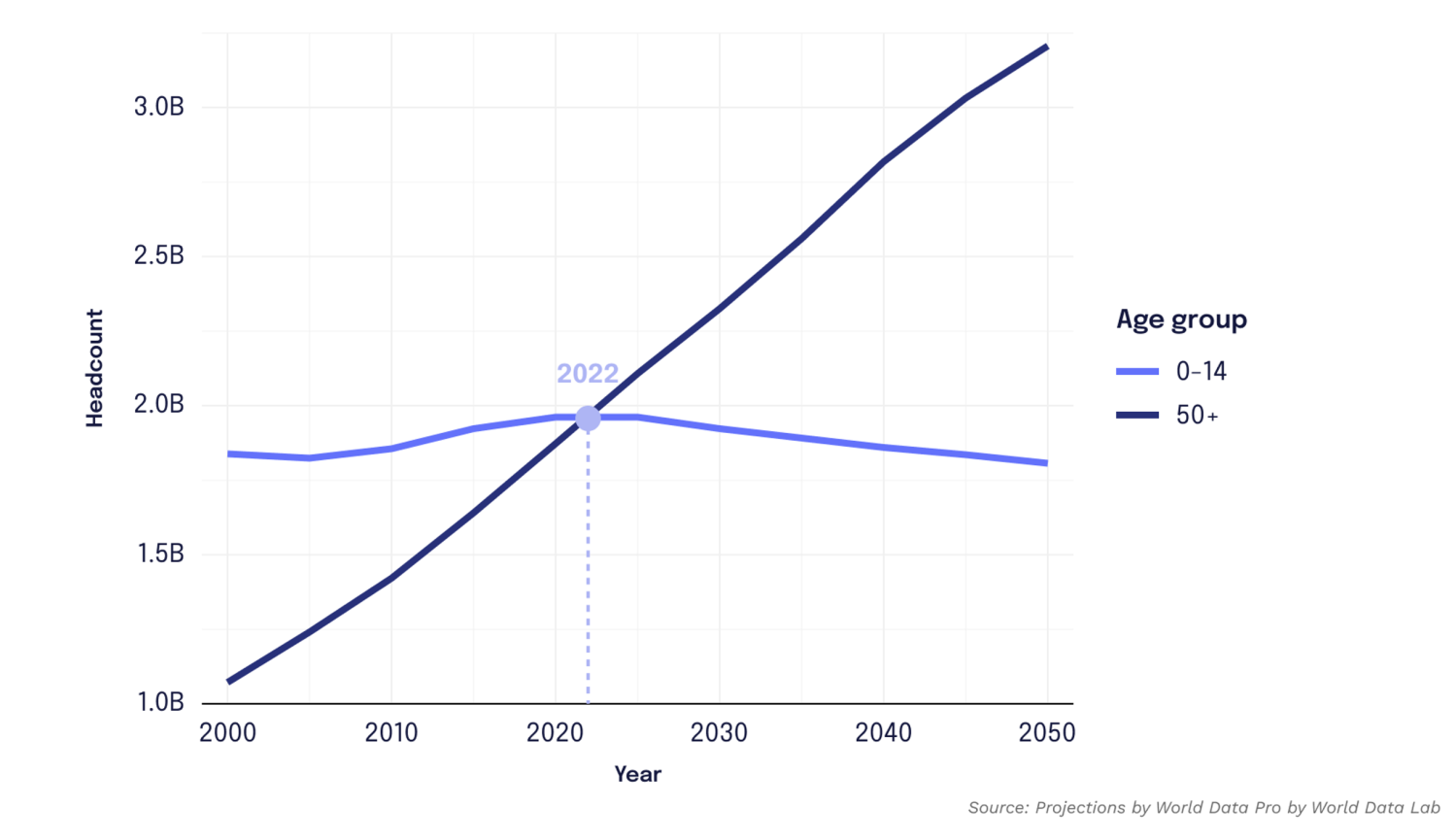

Because demographic shifts are incremental, gradual, and long-term, most people do not look carefully at new data until the change is so significant that they are forced to pay attention. Last year marked three demographic milestones: The global population topped 8 billion; India overtook China as the most populous country in the world; and China saw its first population decrease in decades. Yet, the milestone with perhaps the most significant social and economic implications passed with relatively little fanfare: The number of older adults—those aged 50 and over—surpassed the number of children under the age of 15 for the first time (Figure 1). Broadly speaking, the 8 billion global population is now comprised of 2 billion children, 2 billion older adults, and 4 billion youth and other adults.

Figure 1. Children (0-14) versus older adults (50+)

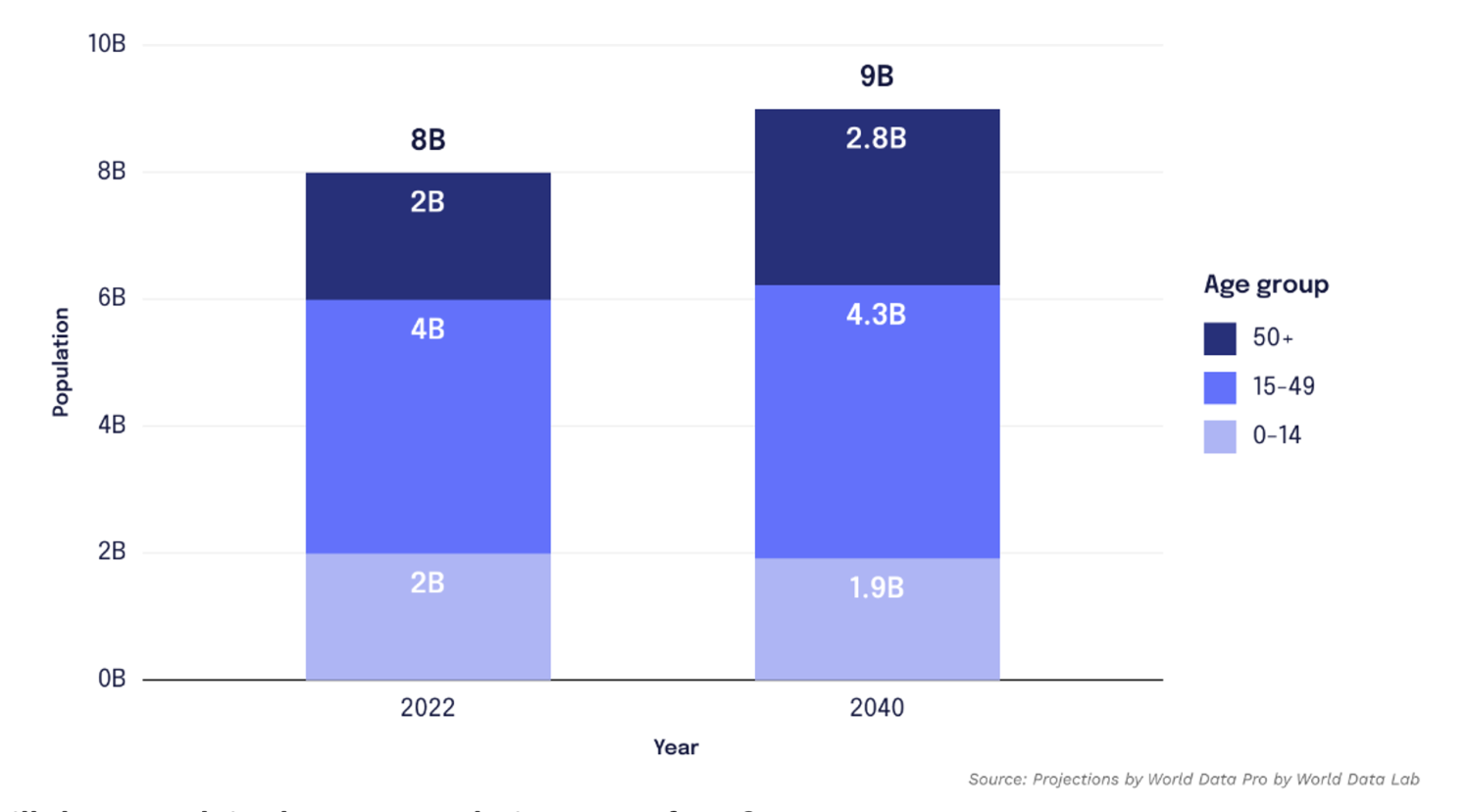

Despite significant changes in demographic trends, the global population continues to rise, with an estimated increase of 75 million people in the next year alone. An important trend implied by the data in Figure 1 is that population growth today is driven by the falling mortality of adults and not by high fertility. In fact, the number of children in the world has peaked and will remain constant at its current level for a couple of decades. What is instead driving population growth is that people are living longer, extending their lives well beyond age 50. So, if we look at the change in age distribution between now and 2040—when the world will have added 1 billion more people—we will see no change in the number of children, but an additional 800 million people in the 50+ age group (Figure 2).

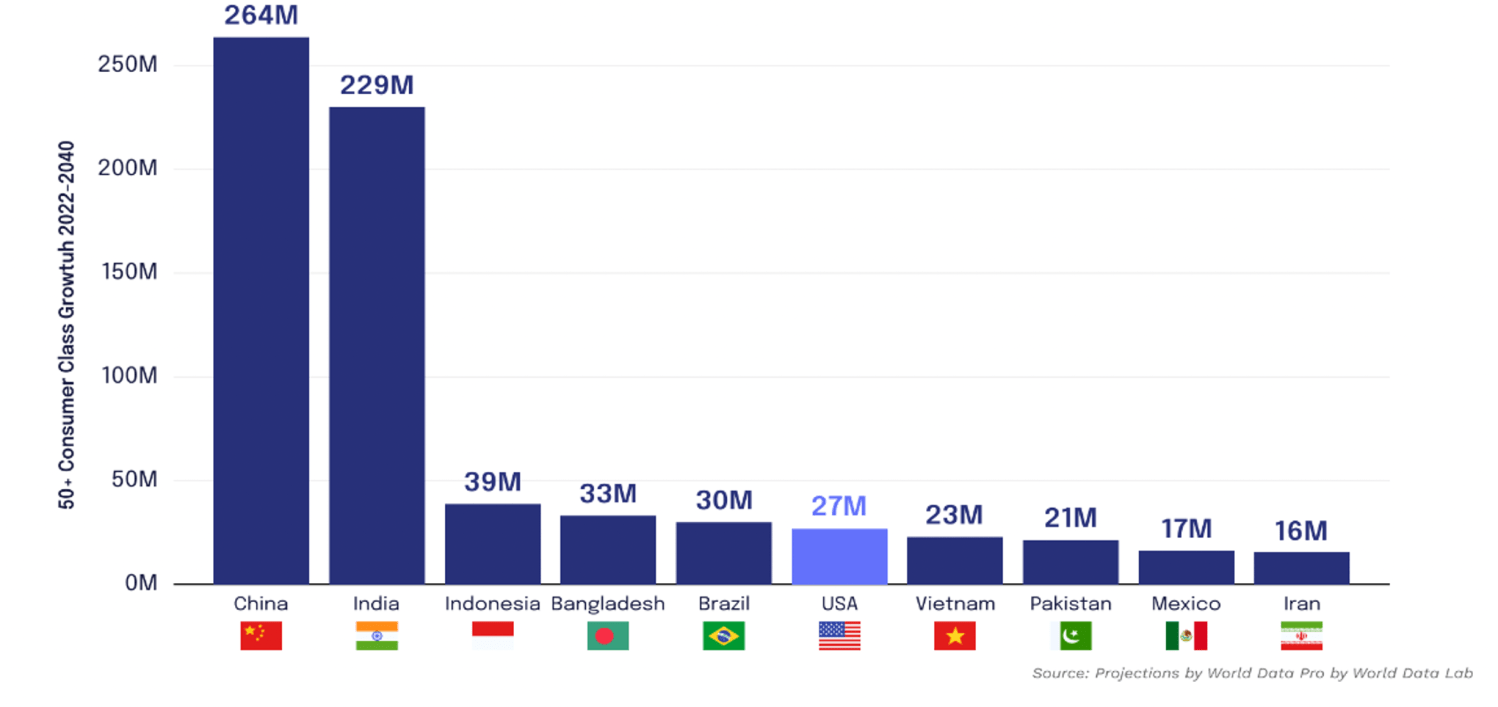

Figure 2. Top 10 movers in the 50+ consumer class (2022-2040)

Where will the growth in the 50+ population come from?

The 800-million-person expansion in the 50+ age group is heavily concentrated in developing countries in Asia. The increase is particularly noticeable in the consumer class, defined as those spending more than $12 per day in 2017 purchasing power parity (PPP). Membership in this consumer class indicates an ability to afford not just basic necessities, but additional goods and services as well. While the overall population is projected to rise by 1 billion by 2040, the consumer class is expected to expand by 2 billion. Figure 3 shows that 700 million of these people will live in 10 low- and middle-income countries, mostly in Asia. The United States is the only high-income country with a significant rise in older adults. If the countries of the European Union were combined, their increase in the number of older adults would be roughly equivalent to that of the U.S.

Figure 3. 50+ consumer class growth (2022-2040)

The country-level breakdown reveals that even though India is the world’s most populous country with a still-growing population, China will have a significantly larger increase in its 50+ consumer class population.

Furthermore, China’s shifting demographics are happening at a comparatively early stage in its economic development. By 2040, China’s older adult population will resemble Japan’s today — its median age will reach 48, compared to 50 in Japan this year. But the average expenditure of a Chinese consumer in 2040 will be only two-thirds as much as a Japanese consumer spends today—hence the observation that China is one of many countries growing old before it grows rich.

Chronicling the power of the Longevity Economy

The Longevity Economy refers to the economic contributions of people aged 50 years and older. According to AARP’s Global Longevity Economy Outlook report, In 2020 the 50-plus population contributed $45 trillion to global GDP, or 34% of the total. That equates to about three times the combined revenue of the world’s 100 highest-earning companies in 2020. World Data Lab projects that the spending growth of this group will be around 5.5% over the next decade. In 2024, older adults account for 42% of total spending worldwide, and as they grow in numbers and in wealth, their relative contribution will continue to steadily rise.

Within this group of older adults, those aged 65 and over will be the biggest spenders. In the large developing countries where the growth is concentrated, the new cohort of seniors will have accumulated higher savings than their predecessors, so per-capita spending will also increase. The combination of these two forces will result in aggregate growth of older adult spending of 6 to 6.5% per year for the next decade, making the 65+ age group the fastest-growing age cohort.

In aging societies, like China, the power of the Longevity Economy is particularly striking. Over the next decade, Chinese seniors are expected to experience twice the spending growth compared to other consumers, driven equally by an increase in the number of older adults and higher spending per citizen in this population segment.

Understanding trendlines before they become headlines

While demographic shifts tend to take place over decades, the past year has borne witness to major milestones that have garnered significant attention with enormous downstream societal and economic implications. Essentially, trendlines have now become headlines. Advancing our understanding of these demographic realities and their consequences in the decades to come will be increasingly important as the world is getting older at a faster pace than ever before.