The continuous growth of the global consumer class is the biggest news that no one is talking about. Surprisingly, neither the global financial crisis, COVID, the war in Ukraine, nor high inflation have stopped the growth of the consumer class. Economic momentum in Asia and higher life expectancy everywhere means that world consumers are countering even the most severe economic shocks in recent years.

World Data Lab defines the consumer class as those spending at least $12 per day (measured in 2017 purchasing power parity, or PPP prices). Each year, the world typically adds between 110-130 million new consumers. The main exception in the past 25 years was in 2020 when the world consumer class fell by 75 million people due to the impact of COVID-19. This setback was, however, short-lived, as 2021 came with a strong rebound, adding 180 million consumers.

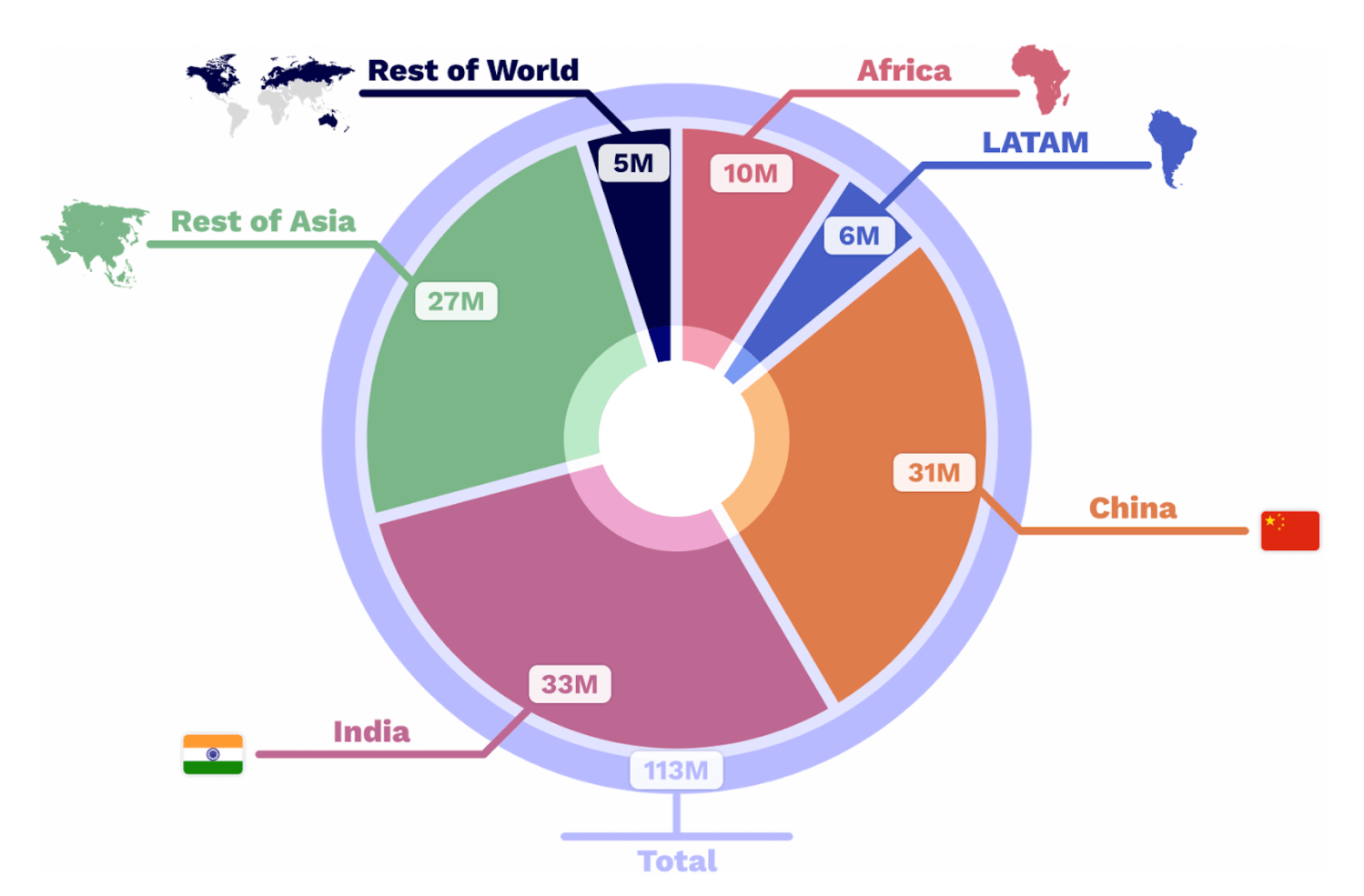

With these latest adjustments, we project that the world has reached a tipping point where more than half its population is in the consumer class: There were probably 4 billion in the consumer class in June 2023, and the world will add 113 million more in 2024. We project that Asia will contribute 81 percent of the new consumers in 2024, with India and China alone accounting for over half of the increase. For the first time, the number of new people in the consumer class in India will outpace China, making India a leading global driver of consumer growth (Figure 1).

Figure 1. In 2024, Asia will contribute 91 million people to global consumer class growth

Source: World Data Lab, World Data Pro

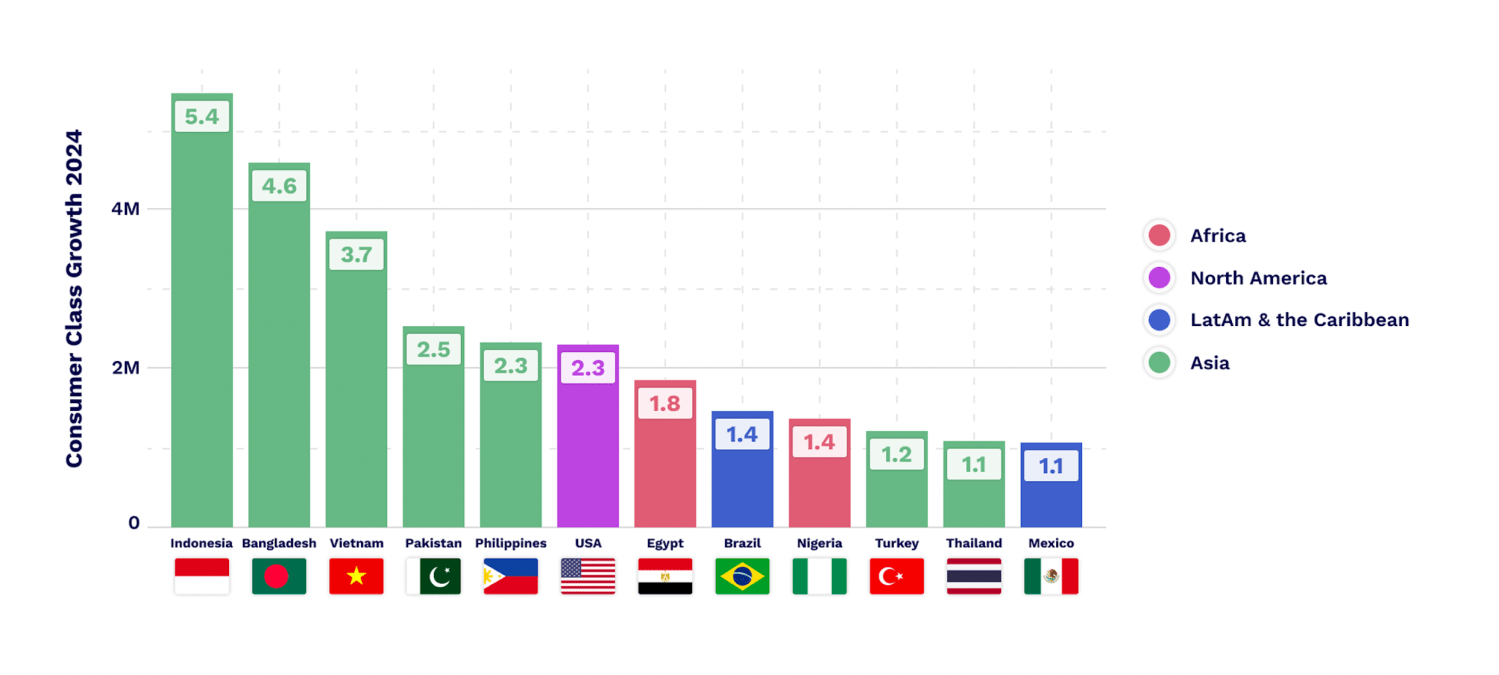

In addition to India and China, 12 other nations will add over 1 million consumers in 2024. This group—the Next 12—is also dominated by Asia with seven economies: Indonesia, Bangladesh, Vietnam, Pakistan, Philippines, Turkey, and Thailand. It also includes Egypt, Nigeria, Mexico, and Brazil. The U.S. is the only advanced economy in this group (figure 2).

Figure 2. Countries adding over 1 million consumers (beyond India and China) in 2024

Source: World Data Lab, World Data Pro

More consumers means more spending. Consumer spending is set to increase by $2.3 trillion ($2017 PPP) in 2024. To put it into perspective, this is like adding another Germany to the consumer market or matching global military spending. While the growth of the consumer class may slow in the 2020s, we expect consumer spending to accelerate. In the previous decade (2010-20), the world witnessed an average addition of 128 million consumers and an average consumer class spending increase of $2 trillion annually. However, in this current decade (2020-2030), projections indicate an annual average growth of 112 million consumers and $2.4 trillion in spending each year, meaning that the purchasing power of each consumer is rising.

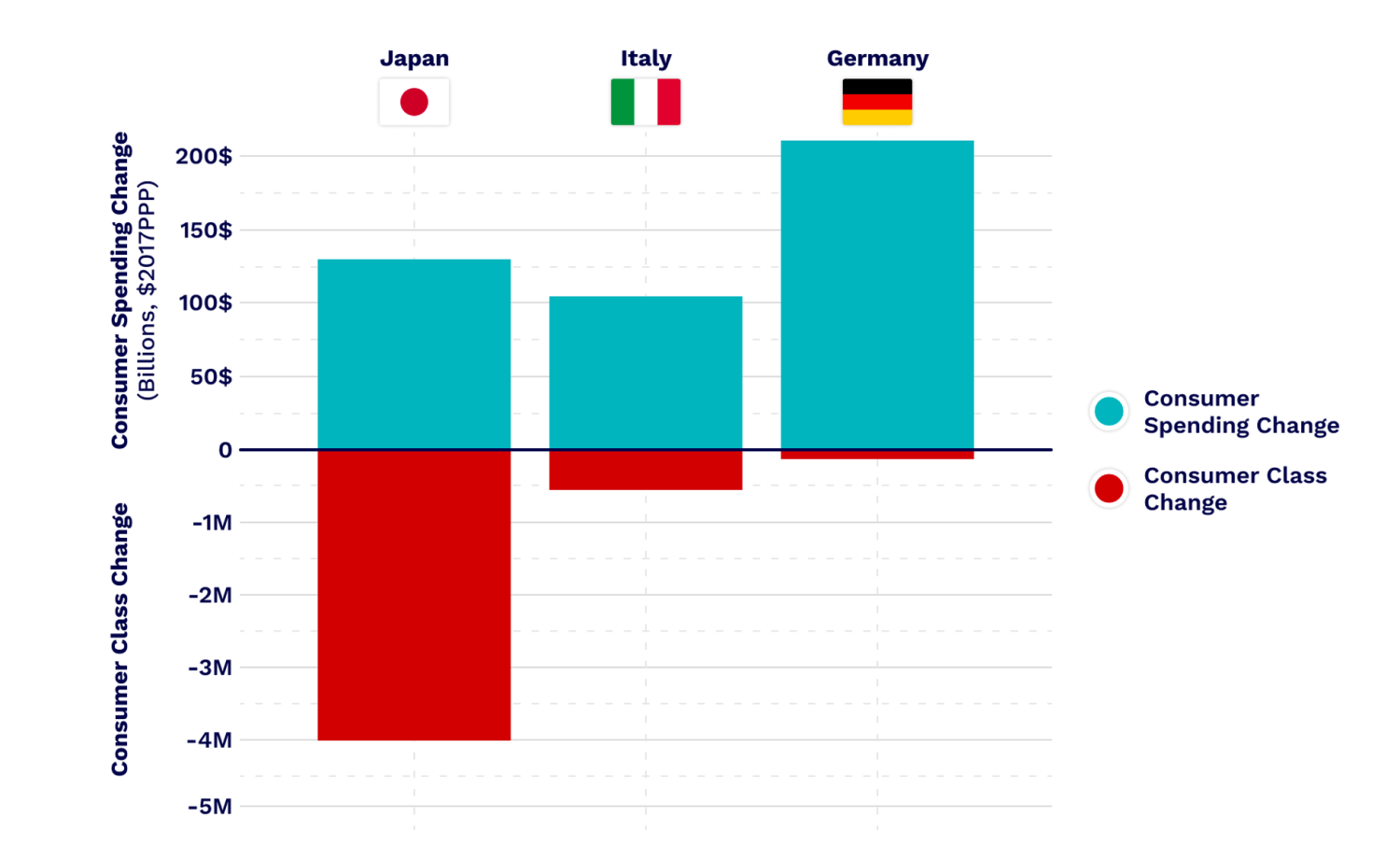

Although the consumer class continues to expand globally, certain countries will see a decline due to aging populations and the long-term impact of lower fertility rates, notably Japan and several European countries. From 2022 to 2030, we project that Japan will lose 4 million consumers, while Italy and Germany’s consumer class will shrink as well (figure 3). As the consumer class ages, the demand for healthcare services, leisure activities, and retirement-related offerings will increase.

Figure 3. Traditional markets are losing consumers but still adding spending (2022-30)

Source: World Data Lab, World Data Pro

Business leaders should anticipate a new world with 5 billion consumers by 2031. Without a major economic shock, the world will add another billion consumers in just eight years—the shortest time ever recorded.

For questions regarding the underlying data model, please contact Juan Caballero-Reina ([email protected]).

This article was originally published on Brookings.